Roger D. Jones

December 10, 2013

Condensed from a presentation to the Center for Complex Systems and Enterprises at the Stevens Institute of Technology on November 12, 2013

Healthcare is so complicated

Healthcare in the U.S. is complicated. There are dozens of components: hospitals, hospices, assisted living facilities, nursing homes, home care, pharmacies, pharmaceutical companies, the Food and Drug Administration, the Patent Office, specialized physicians, general physicians, physicians assistants, nurses, medical device manufacturers, Medicare, Medicaid, private insurers, self insurers, employers, self-employed, wellness centers, chronic conditions, acute conditions, end-of-life conditions, rare diseases, personalized medicine, cosmetic surgery, concierge medicine, and many more. The complication is impossible for any single person to penetrate or understand.

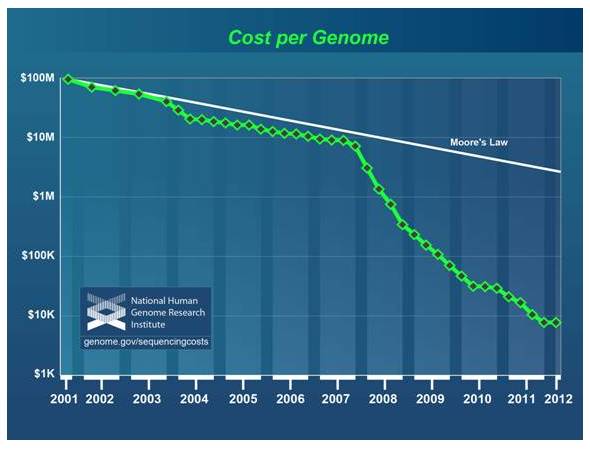

Why is healthcare so complicated? The field is impenetrable because human bodies are complicated. In the early twentieth century bodies were simpler. At that time, people tended to die from acute conditions before their health became Gordian from chronic conditions. Medicine was simpler. It consisted almost solely of providing comfort to those at the end of their lives. Medicine has added years to our life expectancies with the consequent increase in healthcare complication. The higher population densities of today have also added complexity by providing rich biological cultures for infectious diseases. Moreover, personalized medicine is making life bewildering. Sequencing an individual genome is now inexpensive enough for every person to be able to identify his or her own disease susceptibility spectrum, which must be understood and managed individually.

How do we make enough sense out of healthcare so that the system can be managed efficiently and effectively? It is absolutely true that many other countries have healthier populations than the U.S.—at lower cost than we pay in the U.S. Americans, with their love affair with free-markets, will need to find a particularly American solution to the problem that is as successful as the healthcare programs in about 40 other countries. We must discover a general set of principles that cut through the Gordian knot. We have not been in this situation before, so we must create and manage 21st century healthcare without the benefit of precedent or historical data. Fortunately, there is a set of general principles in the theory of Complex Systems that may apply to the healthcare dilemma. It is these principles that we will apply—but perhaps not rigorously— to healthcare in this blog and in future blogs. The principles provide us with a high-level roadmap and a means for organizing our actions. But first, just what is a complex system?

What is a complex system?

A complex system is a structure composed of many interacting components. The components also interact with the environment external to the structure. Examples in physics are liquids, solids, and gases. In social science there are economies, organizations, and societies. In engineering there are weapons systems, traffic, and city planning. A key characteristic of complex systems is that the interactions of the individual, often simple, components lead to unpredictable behavior of the structure as a whole. This behavior is known as emergence. A striking example of emergent behavior is the behavior of the internet. The internet is composed of very many components with no leader, yet it has transformed society in ways that were unpredictable.

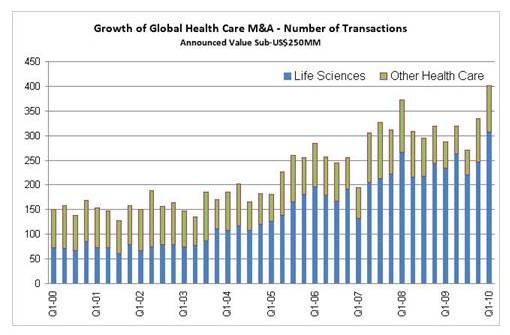

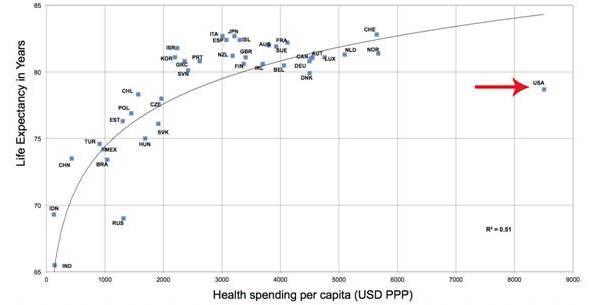

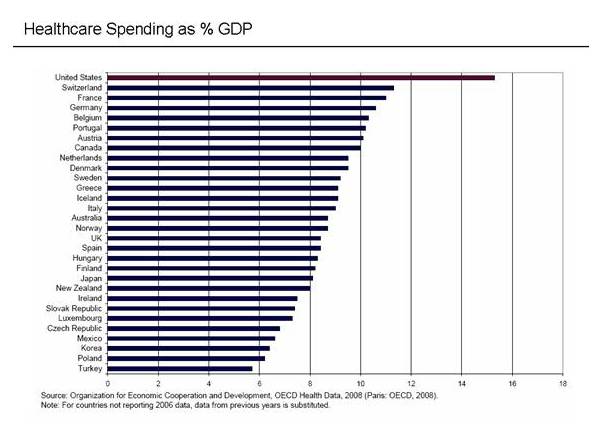

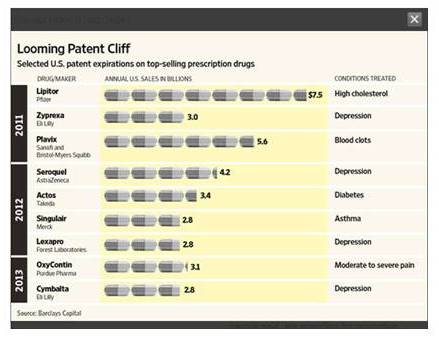

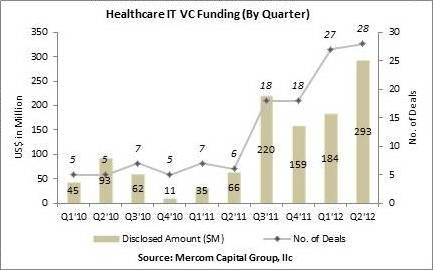

In this and following blogs we will focus on two particular emergent behaviors of complex systems; phase transitions, or X-Events Phase transitions are sudden changes in the structure of the system triggered by changing external forces or large perturbations on the system. An example of a phase transition occurred 65 million years ago when a large asteroid struck the earth changing the climate and eliminating the dinosaurs. The formerly insignificant mammal population was well suited to the new conditions and emerged to fill the empty ecological niche left by the dinosaurs. A phase transition is not necessarily the result of a sudden extreme event. It can result from slowly increasing external forces on the system. An example would be the transition from an agrarian economy in Europe and the U.S. to an industrial economy during the 18th and 19th centuries. This transition was the consequence of very many technological advances in that period. Changes in healthcare may be similar to this less dramatic X-Event process. Fluctuations are short-lived changes in the structure of the system that tend to occur near the conditions for a phase transition. Colloquially, this is known as the “Edge of Chaos.” In economic systems, this regime is often identified with financial opportunity. An example of fluctuations in an economic system would be merger-and-acquisition (M&A) activity. The task at hand is to understand if the concepts of phase transition and fluctuation have relevance to the behavior of the US healthcare system and to see if those concepts inform the management of the system. The first job is to identify the forces on US healthcare and determine if those forces are likely to precipitate a transition in the structure of healthcare. The forces on US healthcare are dramatically illustrated in the following chart, published by the Huffington Post,[2] constructed from information gathered by the Organisation for Economic Co-operation and Development (OECD).[3] Life expectancy vs. healthcare spending per capita by country. Note that the USA is an outlier. Note that the U.S. is an outlier. Spending per capita is higher in the U.S. than every other country by more than $2,000 per person; yet approximately 50 countries out of about 200 have higher life expectancies.[4] [5] For another measure of health outcomes, infant mortality, the U.S. ranks about 34.[6] The picture is no brighter if we look at health expenditure as a fraction of production. Healthcare in the U.S. consumes the largest fraction of production of any other country. In 2011, healthcare costs of $2.6 trillion consumed 17.9% of the US GDP.[7] [8] [9] Moreover, health expenditures are increasing much faster than the inflation rate.[10] The U.S. has the largest healthcare expense as a percentage of GDP. Image source. Clearly, there is potential in the U.S. to both improve outcomes and reduce costs. The disparity between the U.S. and other developed countries is a strong force for change. The forces for change act not only on the healthcare system as a whole, however. Components of healthcare can also feel forces. These forces destabilize the component with respect to other components in healthcare. An example is the pharmaceutical industry, which composes about 12% of the US healthcare expenditure.[11] There are, at least, two strong forces affecting the pharmaceutical industry, the patent cliff and personalized medicine. These forces are large enough to drive a restructuring of the industry. Several blockbuster drugs are going off patent. Image source. The first major force is the patent cliff. From 2009 through 2012 approximately $60B dollars in pharmaceutical sales were lost to the patent cliff, the expiration of drug patents with the consequent drop in prices as cheaper generic drugs replace patented brand drugs.[12] Despite increased R&D expenditure, the drug pipeline has not met the demand for new drugs.[13] The pharmaceutical R&D spend has increased while the product pipeline has remained static. New drugs are not replacing drugs going off patent. Image source. The second major force on the pharmaceutical industry is the emergence of personalized medicine, medicine that is tailored for the individual patient usually based on information at the genomic level for the patient. The cost of sequencing a genome is dropping faster than Moore’s Law;[14] the law that predicts the price drop in semiconductor memory that, in turn, drives the explosive growth in the computer industry. The low cost allows individuals to know their own genome sequence; thus allowing them to know their susceptibility to a spectrum of disease conditions. This will present a number of challenges to healthcare in general and the pharmaceutical industry in particular. The cost of genomic sequencing is dropping faster than Moore’s Law. It has become inexpensive enough for an individual to map his or her own sequence. Image source. An obvious challenge is that physicians will need information-management assistance in diagnosing and treating.[15] The amount of information that must be managed is becoming astronomical. The challenge is the more daunting when one realizes that US healthcare is only just now moving into electronic information management.[16] The concept of a clinical trial must be reworked.[17] The current pharma blockbuster model relies on large test-patient populations to ensure product safety and efficacy. In the era of personalized medicine large populations will not be available for clinical trials. How are products properly vetted in an era when statistical significance is unavailable? Patients will have more influence on the R&D pipeline.[18] It will be possible for patients to have as much or more information about their physical condition than physicians. This allows patient advocacy groups to affect the products in basic R&D and their injection into the clinical-trial process. The Michael J. Fox Foundation is an example of an advocacy group with a great deal of technical information that has had an effect on the Parkinson’s-disease drug pipeline.[19] The list of challenges presented by personalized medicine goes on. Probably the biggest challenges will be those we cannot currently foresee. It is clear, however, that with just the known challenges of the patent cliff and personalized medicine that pharmaceutical-industry restructuring is in the cards. What might a new structure look like? There are currently two visions for healthcare in the U.S.[20] The first vision, which I call the Texas vision, is a continuation of the current system in which providers are compensated for activity and procedures.[21] [22] The second, which I call the Rochester vision, is a system in which providers are compensated for good health outcomes and lower costs rather than procedures and activity. The first vision is an extension of our current trajectory in which space-age technology yields dramatic, but expensive, health outcomes.[23] Gov. Rick Perry of Texas is a champion of the high-technology vision. Tort reform and zero income tax have attracted high-end medical specialists to Texas; thus setting the state up as a destination for medical tourism for sick patients from all over the U.S. and for wealthy patients from all over the world. Perry is less sanguine about non-specialized medicine and primary care in Texas. Perry is candid that many Texans are not receiving adequate primary healthcare. The second vision is one in which common-sense medicine produces low-cost very good health over a large segment of the population, but is not necessarily designed to accommodate specialized high-technology procedures.[24] The Rochester area of New York State is the poster child for this vision. This system emerged as a cooperative arrangement between large local employers, such as Kodak and Xerox, which were trying to manage costs, and a first-rate medical school at the University of Rochester. Of course, Kodak and Xerox are shadows of their former selves in Rochester, but the system they helped create still exists. The key observation was that, contrary to traditional economic theory, increased healthcare supply increases costs. This cynical view is that medical entrepreneurs increase the number of hospital beds, and then prescribe to fill the beds. The Rochester team decided to right-size the supply of healthcare in the community and to focus on outcomes. This was possible because of the economic motivations of the community businesses that were funding the healthcare and the cooperation of the medical school that drove the vision through its training and hiring policies. The Rochester community succeeded in its goal of providing low-cost high-quality healthcare. I am sure, however, that if patients in the Rochester area need a truly exotic life-saving procedure, they have it done in Texas. The two visions emerged as a result of incentive structures. Historically, the US has compensated providers for activity and procedures. This led to a structure of specialists and expensive procedures. Lower-cost effective procedures such as information management have not been rewarded and consequently play a secondary role in today’s healthcare management.[25] The second vision may result from an incentive structure in which good outcomes and low costs are rewarded. Primary care physicians and healthcare technicians; such as home care workers, physicians’ assistants, and nurses; are key to this vision. The second vision expects providers to take on more risk. Revenue from outcomes is less predictable than revenue from activity. It is key to the vision to create a structure of modern healthcare information management that aids the provider in managing the risk. The possible changes that may occur for a component of healthcare, the pharmaceutical industry, are much less clear. The patent cliff and personalized medicine will transform the industry independently of which of the visions for healthcare prevail, but the new structural state for pharma may depend on which global vision or hybrid vision survives. How close are we to an X-Event? The theory of Complex Systems suggests that fluctuations in the structure of the system occur near a phase transition. In the business world fluctuations in structure are represented by startups, bankruptcies, mergers and acquisitions. We should be able to use the level of this type of business activity to measure whether we are approaching a phase transition or moving away from one. The following graph charts the number of middle-market healthcare M&A transactions from 2000 to 2010 by quarter.[26] The number of transactions has more than doubled in that period. The growth is driven by Life Sciences, which is what the pharmaceutical and biotech industries call themselves. The rest of healthcare had a smaller number of transactions and also no growth in the number of transactions. This suggests that the pharmaceutical industry may be experiencing the greatest pressure to change its structure. The number of middle-market healthcare M&A transactions from 2000 to 2010 by quarter. Image source. While the market outside of Life Sciences seems to be experiencing little growth, one might ask if there are individual components within that group that are experiencing an increase in activity. The following graph, for example, illustrates the growth in the healthcare IT activity from 2010 to 2012. Here we see significant increase in activity in transactions and investment.[27] This is consistent with the observation that information management is playing an increasing role in healthcare. The growth in the healthcare IT activity from 2010 to 2012. Image source. The case for M&A activity being a bellwether for an X-Event is suggestive, if not definitive. It is clearly important to understand the M&A relationships among the various sub industries and the forces acting on those industries. This will be an area of further research. One can try to understand healthcare from the detailed behavior of its components. However, just as it is essentially impossible to predict the state of water—ice or liquid—by computer modeling the trajectories and orientations of each water molecule, it is impossible to predict the future state of a complex social system like healthcare by looking at details of the dynamics of its component parts, such as the Affordable Care Act, health insurance contracts, and drug patents. The state of the system will have changed before the calculations can be carried out. Checking the accuracy of the predictions would take even more time. As luminaries like Niels Bohr, Mark Twain, and Yogi Berra have wisely observed, “prediction is difficult, especially about the future.” “Prediction is just difficult, especially about the future” Image source. One can, however, use general principles and a few well-chosen measurements to understand how close a system is to experiencing an X-Event or phase transition—an extreme change in the structure of the system. The fluctuations in the structure of the system signal an impending event, while the nature of essentially unpredictable external forces on the system suggests possible end states that relieve the strain on the system. In the case of US healthcare, fluctuations in the structure are manifested in mergers, acquisitions, bankruptcies, and startups. This activity has been increasing in some areas in the last few years. There are intense forces on the system as a whole and on some of its parts, such as the pharmaceutical industry. Expenses are high and outcomes are low. For pharmaceuticals, revenue is down due to patent expirations and a weak drug pipeline. Personalized medicine is changing the relationships among providers, patients, and payers. The nature of clinical trials must change. Physicians must acquire new information-management tools. Patients have greater control. The indications are that US healthcare may be in the middle of an X-Event. The end result may be that healthcare expenses are lowered and the general health of the nation improves. The relative roles of specialist physicians and general practitioners will adjust. Pharmaceutical business models will change. Personalized medicine will become common. The challenge is to identify a program that will enable us to get a better understanding of what is happening so that we can robustly manage and hedge our way through the changes that are taking place—and to create the right program in the absence of historical data and precedent. This blog is an introduction to the Complexity Science of US Healthcare. Future blogs will explore the topics introduced here in greater detail. In particular, we will examine the properties of complex systems, healthcare as a complex system, the forces on US healthcare, M&A activity in US healthcare as an indicator of a phase transition, and the role of regulation in an economy with infinite demand. [1] John Casti, X-Events: The Collapse of Everything: (New York: HarperCollins, 2012) [2] Mark Gongloff, The U.S. Health Care System Is Terrible, In 1 Enraging Chart, Huffington Post, 26 November 2013, http://www.huffingtonpost.com/2013/11/22/american-health-care-terrible_n_4324967.html, 4 December 2013. [3] Health Policies and Data, OECD, 2013, http://www.oecd.org/health/health-systems/oecdhealthdata.htm, 4 December 2013. [4] The World Factbook, Central Intelligence Agency, 2012, https://www.cia.gov/library/publications/the-world-factbook/rankorder/2102rank.html , 4 December 2013. [5] Global Health Observatory Data Repository, World Health Organization, 2011, http://apps.who.int/gho/data/node.main.688?lang=en, 4 December 2013. [6] The World Factbook, Central Intelligence Agency, 2013, https://www.cia.gov/library/publications/the-world-factbook/fields/2091.html , 7 December 2013. [7] Health and Nutrition: Health Expenditures, United States Census Bureau, 2013, https://www.cia.gov/library/publications/the-world-factbook/fields/2091.htmlhttp://www.census.gov/compendia/statab/cats/health_nutrition/health_expenditures.html , 7 December 2013. [8] The World Factbook, Central Intelligence Agency, 2013, https://www.cia.gov/library/publications/the-world-factbook/fields/2195.html, 7 December 2013. [9] Global Health Observatory Data Repository, World Health Organization, 2011, http://apps.who.int/gho/data/node.main.75, 7 December 2013. [10] The Facts About Rising Health Care Costs, aetna, n. d., http://www.aetna.com/health-reform-connection/aetnas-vision/facts-about-costs.html , 7 December 2013. [11] Zoltán Kaló, András Inotai, Gerg Merész, INTERNATIONAL COMPARISON OF PHARMACEUTICAL EXPENDITURE IN MIDDLE INCOME COUNTRIES: METHODOLOGICAL QUESTIONS, syreon Research Institute, 2011, http://www.ispor.org/research_pdfs/40/pdffiles/PHP44.pdf, 7 December 2013. [12] Timothy Schluter, Weighing Two Drivers for Pharmaceutical Stocks, 22 July 2011, http://www.marketminder.com/s/fisher-investments-weighing-two-drivers-for-pharmaceutical-stocks/13ad7ca9-a3b7-404e-b2f4-fbf484f39321.aspx , 7 December 2013. [13] Phil Taylor, Pharma’s return on R&D spend continues to slide, 5 December 2013, http://www.pmlive.com/pharma_news/pharmas_return_on_r_and_d_spend_continues_to_slide_524156 , 7 December 2013. [14] Nicholas Stoler, Genome Graphic Generator, Nicholas Stoler, 2013, http://nstoler.com/misc/yourgenome.html , 8 December 2013. [15] Roger D. Jones, Goats, Cars, and Personalized Medicine, Qmedicus, 31 March 2013, http://www.qmedicus.com/bloggers/roger-jones/?p=202 , 8 December 2013. [16] Roger D. Jones, Information Management That Improves Health Outcomes and Reduces Costs, Qmedicus, 26 November 2012, http://www.qmedicus.com/bloggers/roger-jones/?p=119 , 8 December 2013. [17] Roger D. Jones, Clinical Trials in the Era of Personalized Medicine, Qmedicus, 2 January 2013, http://www.qmedicus.com/bloggers/roger-jones/?p=169 , 8 December 2013. [18] Roger D. Jones, The Patient-Driven Drug Pipeline, Qmedicus, 2 January 2013, http://www.qmedicus.com/bloggers/roger-jones/?p=173 , 8 December 2013. [19] Jones, The Patient-Driven Drug Pipeline. [20] Roger D. Jones, Two Visions for Healthcare, Qmedicus, 11 December 2012, http://www.qmedicus.com/bloggers/roger-jones/?p=147 , 8 December 2013. [21] Roger D. Jones, Technology and Healthcare Expenditure, Qmedicus, 20 November 2012, http://www.qmedicus.com/bloggers/roger-jones/?p=79 , 8 December 2013. [22] Amitabh Chandra and Jonathan S. Skinner, Technology Growth and Expenditure Growth in Health Care, National Bureau of Economic Research, April 2011, http://www.nber.org/papers/w16953 , 8 December 2013. [23] Jones, Two Visions. [24] Jones, Two Visions. [25] Jones, Information Management. [26] Life Sciences—Leading the M&A Rebound, Benning Associates, 4 September 2010, http://pulse.benningllc.com/2010/04/life-sciences-leading-m-rebound.html , 10 December 2013. [27] Healthcare IT VC Funding Continues to Scale New Heights with $293 Million Raised in Q2 2012, Mercom Capital Group, 2012, http://www.mercomcapital.com/healthcare-it-vc-funding-continues-to-scale-new-heights-with-$293-million-raised-in-q2-2012, 10 December 2013.Economic forces on US healthcare

Economic forces on a component of US healthcare: Pharmaceutical Industry

What are possible structures for US healthcare?

M&A activity as a measure of the imminence of a structural shift in US healthcare

What does this all mean?

Future Blogs

Leave A Comment